The "la Caixa" Foundation supports ground-breaking research at the Barcelona School of Economics through the "la Caixa" Foundation Research Grants on Socioeconomic Well-being.

Project overview

The goal of this project is to build a macroeconomic framework integrating a state-of-the-art features of growth and business cycles models, and to use it as a “laboratory” to shed lights on several open research questions. First, it will be used to understand how investment in innovation and productivity growth react to changes in monetary and fiscal policy. Second, the model will provide insights on the response of productivity growth to large shocks, such as severe financial crises. Third, the model will be used to evaluate quantitatively the stagnation traps hypothesis recently advanced in the literature. Fourth, the model will be used to derive normative implications on the optimal conduct of stabilization policies, such as fiscal or monetary policy.

Main results

- Development of a state-of-the-art Keynesian Growth framework

- Paper on “Monetary Union and Financial Integration”

- Paper on “The Global Financial Resource Curse"

Summary, output, and dissemination

- Research summary

-

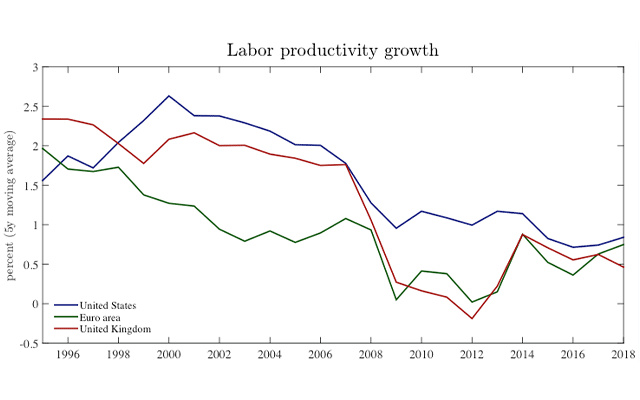

During the last 20 years, most advanced economies have experienced a dramatic productivity growth slowdown (see Figure 1). This fact has been a major source of concern for policymakers, who are now looking for policy interventions to revive productivity growth. So far, the debate has been centered around supply-side policies, such as structural reforms on the labor or product market. This project has been part of a larger effort to develop a novel Keynesian growth approach, which instead emphasizes the relationship between the demand side of the economy and productivity growth.

The development of a novel Keynesian Growth framework, integrating the study of business cycles and long-run productivity growth, represents a significant deviation from standard macroeconomic models, which typically treat economic fluctuations and long-run growth as two isolated phenomena. Instead, the Keynesian Growth model internalizes the lessons of two literatures. As in the Keynesian tradition, changes in aggregate demand can generate fluctuations in employment and business cycles. Moreover, following the insights of the Schumpeterian growth literature, long-run productivity growth is endogenous and results from firms’ investment.

Thinking jointly about growth and business cycles opens up several novel research questions. Do deep recessions, such as the one triggered by the 2008 financial crisis, depress long-run productivity growth? Should productivity growth enter among the monetary policy objectives? Can policies aiming at stimulating firms’ investment sustain aggregate demand, through their impact on long-run income expectations? These questions are at the forefront of the current policy debate, and the Keynesian growth model represents an ideal laboratory to address them.

This project lays the necessary background work to build up a workhorse Keynesian Growth model. This has been a challenging task, involving the implementation of frontier numerical solution methods. The work is expected to translate into several high-impact papers in the future. In fact, it has garnered an ERC Starting Grant for principal investigator Luca Fornaro to further develop this research line.

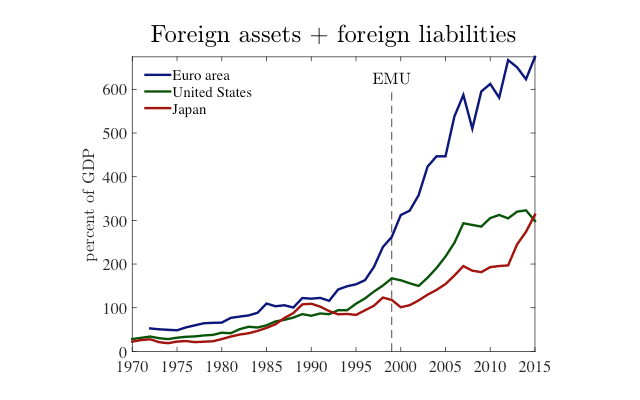

A second facet of the project explores the connection between financial globalization and productivity growth. Since the early 1980s, in fact, the world has experienced a marked increase in international financial flows (See Figure 2). The hope was that this process of financial globalization would lead to faster global productivity growth. But, at least for advanced economies, this has not been the case. Understanding why is important to design policies to manage the process of financial globalization.

Two papers on this topic have emerged from the project. The first one is titled “Monetary Union and Financial Integration”. The paper provides a model in which forming a monetary union fosters financial integration, by eliminating exchange rate risk. The model thus provides an explanation for the increase in international financial flows that euro area members have experienced since the adoption of the common currency. The analysis also suggests that forming a monetary union might lead to capital misallocation and a drop in productivity growth. The model also points toward several policy interventions needed to ensure that monetary union enjoy high healthy growth. This work thus contributes to the debate on the reforms needed to make the euro viable.

The second paper, which is joint with Gianluca Benigno and Martin Wolf, is titled “The Global Financial Resource Curse”. The key idea of the paper is that capital flows from emerging countries to advanced economies, think about the large amount of capital that has flowed from China and other East Asian countries to the US since the late 1990s, might generate a drop in global growth. The reason is that capital inflows produce a currency appreciation. In turn, the appreciation makes firms in the tradable sector uncompetitive, reducing firms’ investment in innovation. The authors show that this effect can be strong enough to reduce global growth. The paper should be out by the end of 2019.

- Competitive European funding

-

ERC Starting Grant

The principal investigator Luca Fornaro has recently been awarded an ERC Starting Grant to further develop the state-of-the-art Keynesian Growth framework first developed during this project. Accomplishing this task was challenging, because it involved the use of frontier numerical solution methods. This project has a high potential payoff, since the model will allow further study of a number of novel research questions.

Duisenberg Fellowship

The Duisenberg Fellowship is awarded by the European Central Bank. It consists of a three-month visit to the ECB in Frankfurt to work on the link between monetary union, financial integration and productivity growth. Principal investigator Luca Fornaro will begin his fellowship in Fall 2020.

- Dissemination and related activities

-

Presentations of the paper "Monetary Union and Financial Integration"

- Oxford / New York Fed Monetary Economics Conference

- Université Catholique de Louvain

- CEPR IMF Programme Meeting

- CREI

Blog posts

- "The Keynesian Growth Approach to Macroeconomic Policy and Productivity" with G. Benigno, Liberty Street Economics, April 2019.

- "Weak Productivity and Monetary Policy: A Keynesian Growth Perspective” with G. Benigno, Vox.eu, March 2018.

BSE Summer Forum

- Organization of Workshop on International Capital Flows (2018)